Content

- Company

- Common control transactions

- Future of Work: Ways of working in uncertain times

- Can Your Accounting Software Manage Multiple Entities?

- Drive Business Performance With Datarails

- NetSuite Financial Consolidation Features

- Step 6. Investigate Asset, Liability, and Equity Account Balances

- Easier Financial Consolidation

Their share in the profit or loss for the year is presented under the heading “Net income attributed to non-controlling interests” in the accompanying consolidated income statement . Is the process of joining the financial data of a company’s subsidiaries and segments (e.g., entities that company controls) into a single set of financial statements. Because the parent company controls its subsidiaries, it makes sense that the assets, liabilities, equity, income, expenses, and cash flows of the parent and its subsidiaries be presented in a financial statement as if they were a single economic entity. Based on the structure of agreements with shareholders holding non-controlling interests in specific Group companies, PUMA is the economic owner when it has a majority stake. The companies are fully included in the consolidated financial statements and, therefore, non-controlling interests are not disclosed. The present value of the capital shares attributable to the non-controlling shareholders and the present value of the residual purchase prices expected due to corporate performance are included in the capital consolidation as acquisition costs for the holdings. The costs directly attributable to the purchase and later differences of the present values of the expected residual purchase prices are recognized in the income statement in accordance with IFRS 3.

How do you consolidate a balance sheet subsidiary?

The consolidation method works by reporting the subsidiary's balances in a combined statement along with the parent company's balances, hence “consolidated”. Under the consolidation method, a parent company combines its own revenue with 100% of the revenue of the subsidiary.

A combined statement with the financial data of both the parent and subsidiary companies is created. The subsidiary’s revenue, liabilities, profits, losses, etc., are consolidated with the parent’s. Thus, the parent combines all of its revenue with its subsidiary’s revenue.

Company

Under the new standard, a private company could make and accounting policy election to not apply VIE guidance to legal entities under common control when certain criteria are met. This accounting policy election must be applied by a private company to all current and future legal entities under common control that meet the criteria for applying the alternative. A private company will be required to continue to apply other consolidation guidance, specifically the voting interest entity guidance.

In this case, let us calculate the consolidated revenue for the year 31st Dec 20XX. In this case, the other investment of $37,500 ($187,500-$150,000) are minority interests. For international reporting, companies must also work within the procedures set forth by the International Accounting Standards Board’s International Financial Reporting Standards .

Common control transactions

Despite Forward Co.’s shareholding falling within the range of 20-50%, their shares are non-voting. Equity InvestmentEquity investment is the amount pooled in by the investors in the shares of the companies listed on the stock exchange for trading. The shareholders make gain from such holdings in the form of returns or increase in stock value. Planful Podcast Learn how finance and accounting pros are making big changes.Events Join us at live and virtual events and webinars around the world.Planful Perform The premier event for finance and accounting professionals.Resource Center Learn new features and get answers to your questions. Dr.Investments in Subsidiary10,000,000Cr.Cash10,000,000Parent Company now has $10M less cash, but still has a total of $20M in assets. Parent Company has recently just begun operation and, thus, has a simple financial structure. Mr. Parent, the sole owner of Parent Company, injects $20M cash into his business.

The method involves the measurement of the consideration received for the business combination and its allocation to the assets, liabilities and contingent liabilities measured according to their fair value, at the purchase date. A subsidiary with minority shareholders must also provide its separate financial statements. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients.

Future of Work: Ways of working in uncertain times

If there is control based on the preceding guidelines, the securitization funds are integrated into the consolidated Group. If the Group’s exposure to the changes in future net cash flows of securitized assets is not significant, the risks and benefits inherent to them will be deemed to have been substantially transferred. In this case, the Group could derecognize the securitized assets from the consolidated balance sheet.

- Private Equity SoftLedger enables greater visibility into your data so you can harness opportunities as they arise.

- CS Professional Suite Integrated software and services for tax and accounting professionals.

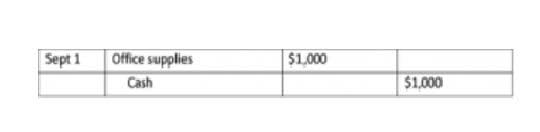

- Here, every transaction must have at least 2 accounts , with one being debited & the other being credited.

- Datarails software integrates easily with current systems and consolidates them to deliver actionable insights.

Assumptions and estimates are made in particular with regard to evaluating the control of companies with non-controlling interests, the measurement of goodwill and brands, pension obligations, derivative financial instruments and taxes. The most significant forward-looking assumptions and sources of estimation and uncertainty as of the reporting date concerning the above-mentioned items are discussed below.

Can Your Accounting Software Manage Multiple Entities?

The BBVA Group’s criteria for determining the recoverable amount of these assets is based on up-to-date independent appraisals that are no more than one year old at most, unless there are other indications of impairment. However, due to the dimension of the Group, and to the proactive management of its country risk exposure, the allowances recognized in this connection are not material with respect to the credit loss allowances recognized. As of December 31, 2011, 2010 and 2009, these country risk allowances represent 0.43%, 0.37% and 0.52% of the credit loss allowances recognized of the Group. All the amounts that are expected to be recovered over the residual life of the instrument; including, where appropriate, those which may result from the collaterals and other credit enhancements provided for the instrument . Impairment losses include an estimate for the possibility of collecting accrued, past-due and uncollected interest. Appendix I shows BBVA’s individual financial statements as of December 31, 2011 and 2010. In all cases, results of subsidiaries acquired by the BBVA Group in a particular year are included taking into account only the period from the date of acquisition to year-end.

- These commitments are funded by insurance contracts and internal provisions.

- The Group sells footwear, apparel and accessories both to wholesalers and directly to customers through its own retail stores.

- The settlement of these obligations is deemed likely to entail an outflow of resources embodying economic benefits .

- You should have demonstrated financial analytical skills that include the ability to evaluate both industry and individual company information and comprehend advanced accounting topics.

- The credit risk is determined by application of criteria similar to those established for quantifying impairment losses on debt instruments measured at amortized cost (see Note 2.2.1).

- Financial accounting rules generally define a controlling stake as between 20% and 50% of a company.

He has contributed to USA Today, The Des Moines Register and Better Homes and Gardens”publications. Merritt has a journalism degree from Drake University and is pursuing an MBA from the University of Iowa. The freedom to alter almost anything in spreadsheets is the root cause of multiple frauds and data manipulation which has happened countless times in the past, and even today. Customers, partners, employees and communities are demanding more transparency into the inner workings of companies and how companies impact the environments in which they operate. Companies are facing tighter regulations regarding filing deadlines, integrity and business disclosures from global financial markets.

Drive Business Performance With Datarails

Drive finance insights from Prophix into Microsoft Power BI to transform your data into actionable insights that inform… Any delay between the deal closing and related invoicing increases your Days Sales Outstanding and therefore negatively impacts your cash flow. After you create a client record, you cannot change the master client status of that client. All master clients remain master clients and all non-master clients remain non-master clients.

In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Equity consolidation is an accounting method used if the investor does not have full control over the subsidiary. For an investor to significantly influence the company, they should own between 20-50% of the shares. Likewise, in scenarios where the investor controls less than 20% of shares and is significant, one uses equity consolidation. General Ledger System – works well if an organization has a single ERP system, but becomes cumbersome if there is a need to collect consolidated financial statements and results from multiple systems used by different locations or subsidiaries.

Consolidated Accounting

Therefore, the reporting and accounting of the subsidiary are under the complete control of the parent company. If the parent company has been consolidating the cash balances of its subsidiaries into an investment account, record intercompany loans from the subsidiaries to the parent company. Also record an interest income allocation for the interest earned on consolidated investments from the parent company down to the subsidiaries. Intangible assets with an indefinite useful life are not amortised according to schedule but are subjected to an annual impairment test. Property, plant and equipment, right-of-use assets, and other intangible assets with finite useful lives are tested for impairment if there is any indication of impairment in the value of the asset concerned. In order to determine whether there is a requirement to record the impairment of an asset, the recoverable amount of the respective asset is compared with the carrying amount of the asset. If the recoverable amount is lower than the carrying amount, the difference is recorded as an impairment loss.

These financial assets are recognized at acquisition cost, and the gains or losses arising on their disposal are credited or debited, as appropriate, to the heading “Stockholders’ funds – Reserves” in the consolidated balance sheets . The BBVA Group has applied the most stringent criteria for determining whether or not it retains the risks and rewards on such assets for all securitizations performed since January 1, 2004. The impairment losses on debt securities included in the “Available-for-sale financial asset” portfolio are equal to the positive difference between their acquisition cost , after deducting any impairment loss previously recognized in the consolidated income statement, and their fair value. Appendix IV shows the main figures for jointly controlled entities consolidated using the equity method. Note 17 details the impact that application of the proportionate consolidation method on these entities would have had on the consolidated balance sheet and income statement. When consolidating financial statements, all of the subsidiary company’s assets become assets on the parent company’s balance sheet.

Their balance reflects the portion of the premiums accrued until year-end that has to be allocated to the period between the year-end and the end of the policy period. The cash-generating units to which goodwill has been allocated are tested for impairment .

Amounts collected on behalf of third parties are not included in the sales revenues. The Group records sales revenues at the time when PUMA fulfills its performance obligation to the customer and has transferred the right of disposal over the product to the customer. PUMA uses cash-settled share-based payments and key performance indicator-based long-term incentive programs. An onerous contract is assumed to exist where the unavoidable costs for fulfilling the contract exceed the economic benefit arising from this contract. As a general rule, current financial liabilities also include those long-term loans that have a maximum residual term of up to one year. Goodwill amounts are allocated to the Group’s cash-generating units that are expected to benefit from the synergy effects resulting from the business combination.

Step 6. Investigate Asset, Liability, and Equity Account Balances

If receivables and liabilities are long-term and capital-replacing in nature, the currency difference is recognized directly in equity and under Other Comprehensive Income. Multi-entity and multi-book accounting capabilities, combined with real-time data, make consolidating and reporting financial details extremely easy. NetSuite Consolidation Accounting combines a shared dataset with the ability to create custom charts of accounts at the subsidiary level to ensure transactions recorded locally are also posted — simultaneously — to the correct parent account. This eliminates the need to normalize and match data and allows for more accurate and timely consolidated reporting.

KnowledgeBrief helps companies and individuals to get ahead and stay ahead in business. Would you like instant online access to Consolidated Accounting and hundreds https://www.bookstime.com/ of other essential business management techniques completely free? The top 50 of hundreds of business management techniques, concepts and ideas in KnowledgeBrief.